Put an “HMS” in front of the word “Hawk” in the title of this post and one might think it describes some World War II duel between a German U-boat and a British destroyer, but in fact the “Hawk” in question is any Federal Reserve official inclined to tighten monetary policy, and the “U6” lurks not beneath the frigid waters of the North Atlantic but rather in the data of the Bureau of Labor Statistics, though it’s certain to surface at this week’s Jackson Hole conference on central bank policy.

A broader measure of distress in the labor market than the U3 statistic generally referred to as the unemployment rate, U6 reflects not only unemployed workers but those who are “marginally attached,” including those with part-time jobs wishing for fuller employment as well as potential workers discouraged or otherwise incentivized to cease looking for work. Thus, U6 represents hidden slack in the labor market, a reserve of individuals whose potential reentry into the workforce could help contain wage inflation even as the Fed maintains unusually accommodative monetary policy.

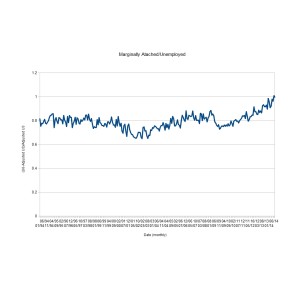

The reality is that even as an inflation-wary FOMC tapers its quantitative easing program and looks to the day it can raise short-term interest rates from essentially zero, Janet Yellen and her colleagues confront an extraordinarily high number of underemployed and discouraged workers, especially as compared to the number of “conventionally” unemployed measured by U3. One can get a sense of this by comparing the ratio of marginally attached workers included in U6 to the unemployed as measured in U3*. The result can be seen in the chart below:

The data goes back to the beginning of 1994, when the BLS began tracking marginally attached workers and computing U6. As the chart shows, for most of the last twenty years the ratio has floated around .8, falling at times to a bit above .6 and rising to a little below .9 on occasion. Yet, in the current recovery, the ratio has risen to unprecedented heights (especially in the last few months) rising above 1 for the first time in June even as U3 itself declined (in July the ratio eased slightly to just above .99). This reflects the fact that even as U3 unemployment has fallen, a large pool of jobless or underemployed have remained in that unhappy position and uncounted in the generally reported unemployment figure.

The data goes back to the beginning of 1994, when the BLS began tracking marginally attached workers and computing U6. As the chart shows, for most of the last twenty years the ratio has floated around .8, falling at times to a bit above .6 and rising to a little below .9 on occasion. Yet, in the current recovery, the ratio has risen to unprecedented heights (especially in the last few months) rising above 1 for the first time in June even as U3 itself declined (in July the ratio eased slightly to just above .99). This reflects the fact that even as U3 unemployment has fallen, a large pool of jobless or underemployed have remained in that unhappy position and uncounted in the generally reported unemployment figure.

The bottom line is that for every person officially unemployed there is another either not looking for a job or desiring more work than they have been able to attain. That spells enough hidden supply in the labor market to potentially discourage accelerated tightening, even as just released Fed minutes indicate increased hiring has made some FOMC members hopeful of a chance to raise rates sooner rather than later.

Unless U6 dives a fair bit deeper, it remains poised to torpedo the hawk’s plans for an early return to more “normal” monetary policy.

*Since the BLS uses the civilian labor force alone for the base in calculating U3 and adds marginally attached workers in figuring U6, the ratio here is computed by taking the ratio of the difference between U6 and an “adjusted” U3 to that same adjusted U3, the adjustment consisting of multiplying U3 by the sum of the civilian labor force and marginally attached workers, then dividing by the civilian labor force. All figures are seasonally adjusted except attached workers, which the BLS does are not seasonally adjust though it uses that series in calculating seasonally adjusted U6.